By Lowell Bolken

Vice President and Portfolio Manager

Securian Asset Management

Securian AM Real Asset Income Fund

The U.S. economic backdrop will likely go through profound changes in the years to come, a large degree due to the COVID-19 experience, but with trends that were already in motion, which were perhaps accelerated as a result.

EXECUTIVE SUMMARY

The coming infrastructure investment bill contemplated by the Biden Administration and the U.S. Congress will likely provide financial backing to boost this progression, but we expect private capital to supplement what looks to be a large infrastructure capital expenditure wave, owing to decades of under-investment.

What were the trends already in motion? In addition to the obvious technology/communication advancements, industry sectors such as energy, housing, retail, and transportation, were already evolving rapidly along the technology and climate-friendly spectrum. As to the latter, ESG (Environment, Social, Governance), a movement that began long before 2020, effectively wraps around these initiatives with a major influence that is expected to pervade investor mindsets for years to come.

Finally, we would be remiss if we didn’t mention the large Millennial demographic which will effect these changes, with a mindset that we feel that has a higher acceptance to change, with the Generation Z following them even more so. It is worth noting that the last time such a large demographic group reached their peak earnings years was also the last period of elevated and sustained economic inflation in the U.S. economy. Of course, this doesn’t guarantee a repeat of this phenomenon, but it is on the top of investors’ minds, as is the current low interest rate environment.

The sweet spot, so to speak, is a real asset investment that carries with it a current income component, with equity upside as the forementioned industries advance along the technology advancement spectrum.

Energy Infrastructure

Despite the attention that the technology sector attracts, we believe the backbone of the U.S. economy is energy and physical infrastructure. As to the former, the wildfire-related blackouts in California last year and the Texas Uri winter storm this year vividly highlighted this, while also demonstrating the need for infrastructure investment. This itself is a sector that blurs the distinction with “tech,” as the future of the industry is proceeding towards a low-carbon emission, renewable goal that will require and attract billions of investment capital dollars in new technology.

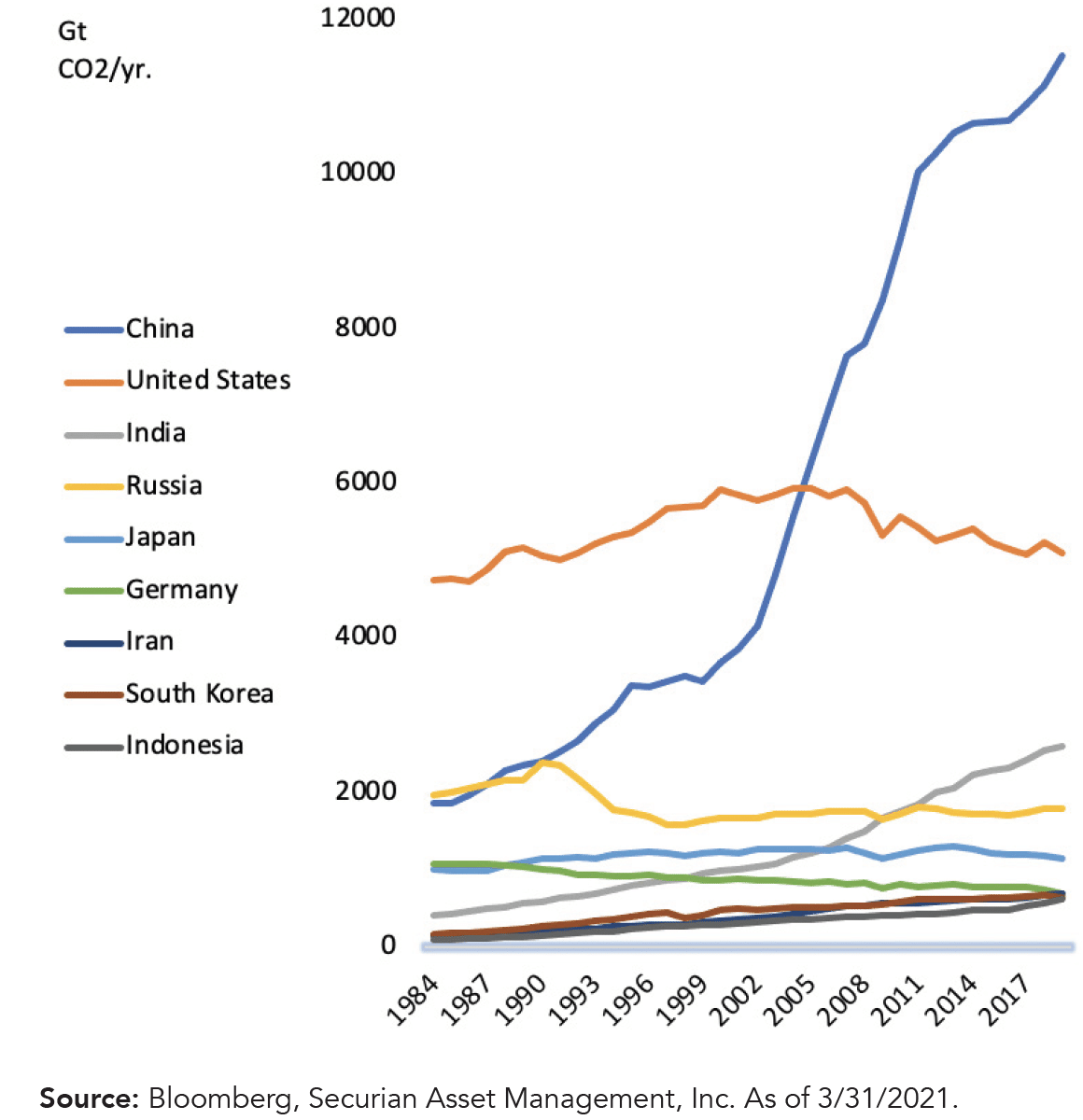

The industry already can already lay claim to the U.S. becoming one of the few larger countries in the world to reduce carbon emissions since 2014 (see Chart 1). This has been primarily due to the transition from coal-generated base load electricity to natural gas plants with little if any give-up in cost to the ratepayers.

CHART 1: FOSSIL CO2 EMISSIONS BY COUNTRY 1980-2019

The electric utility industry is an example of this generational change. Though a portion of the public companies are highly regulated at both state and federal levels, they provide a programmatic approach to implementing current and future zero carbon emission technology that maximizes the synthesis of renewable resources, primarily solar and wind, to generate electricity. Most U.S. states have instituted renewable mandates through their regulatory bodies. The federal government provides further economic subsidies in this regard.

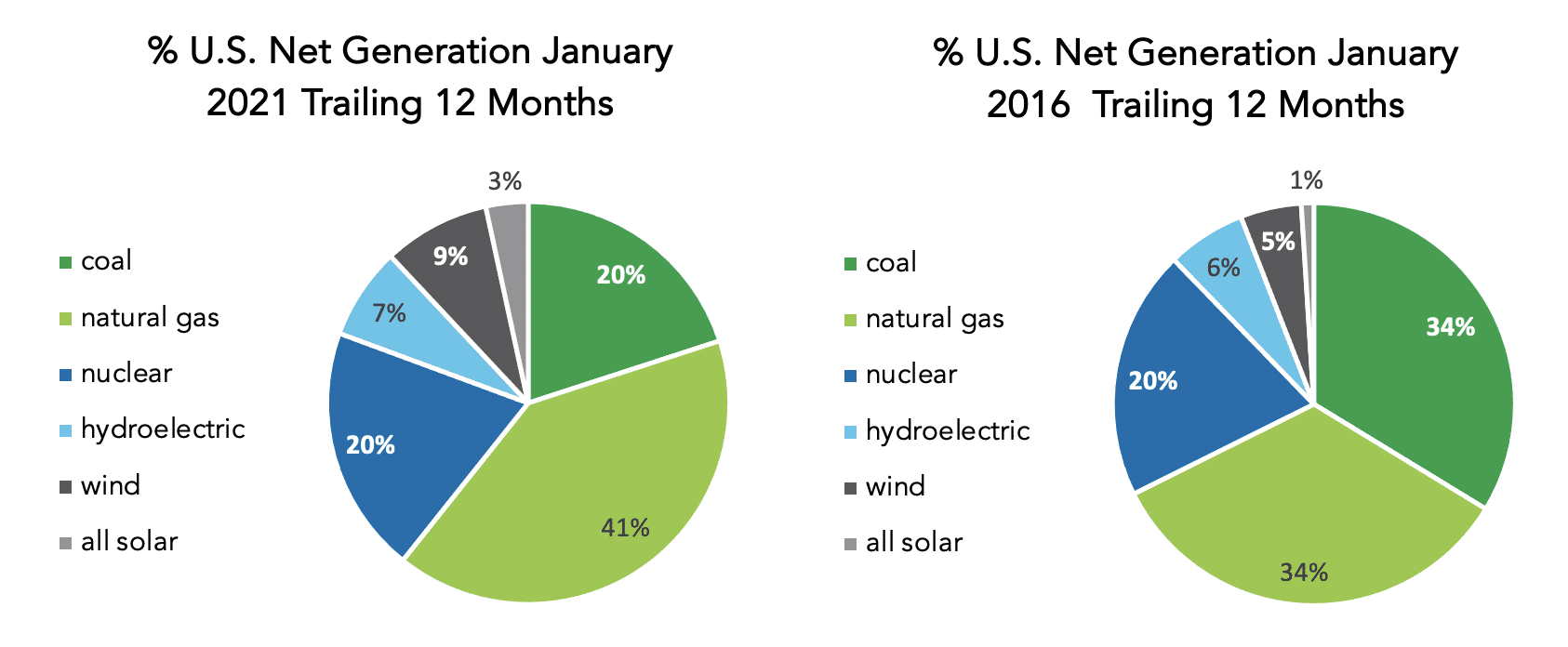

This has fueled enormous growth in wind and solar generation as the former grew from 55 million megawatt-hours (MWh) in 2008 to 275 million MWh in 2018, and the latter has increased from 2 million MWh in 2008 to 96 million MWh in 2018, according to the EIA. Yet this growth has amounted to only 9% of U.S. utility-scale generation (7% wind, 2% solar, according to the EIA), highlighting the potential for growth within the industry.

Also, primarily due to the intermittency of wind and solar, a similar amount of enthusiasm and investment has been dedicated to large-scale battery storage technology. Some states and utility companies have set future zero carbon goals, likely ensuring continued future investment as storage is a key to their stretch targets. The electric utility industry is embarking on this opportunity by installing new generation battery storage in what could be even more disproportionate growth – also an opportunity for selective investors.

Going forward, a further transition is evolving towards new developments in solar, wind, battery, hydrogen, and other renewable technologies. Even advanced nuclear technology may have a place as a carbon friendly but reliable baseload technology. Carbon capture may also introduce a “green” method to extend reliance on natural gas in the future. While these efforts have advanced dramatically in recent years, we believe that a lesser known, but more critical technical puzzle that needs to be solved is the nation’s grid system (see California and Texas), which sometimes struggles to integrate the intermittency that is endemic to the renewable sources.

These initiatives provide the nucleus of business plans for energy infrastructure companies; however, the transition will likely take longer than most assume because of the massive task ahead. The natural gas/coal transition provided a lower carbon bridge that gave some headroom on cost to the consumer, savings that has likely allowed more energy providers to introduce new generation technologies. Until the happy marriage between the electric grid and these advanced technologies occurs, and major advancements and/or lower cost battery storage are introduced, natural gas and nuclear will likely still provide the bulk of dependable baseload for years to come (see Chart 2 below).

Though in some cases, normalized renewable generation costs have become economic, less intermittent options such as hydrogen, still pose a major cost hurdle. Nonetheless, we are optimistic that the U.S. has the right mix of public/private, regulated/non-regulated organizations to implement this transition over the decades to come. The investment options for this transition are many, and we believe the public markets provide an efficient, liquid avenue to participate in this generational change.

CHART 2: PERCENT NET GENERATION BY ENERGY TYPE 2016 VS 2021

Source: U.S. Energy Information Administration

Finally, the advent of lower-cost power has been a boost for the manufacturing sector in the U.S. This has drawn many international companies, particularly in the automobile industry, to invest in manufacturing plants in the U.S. Though lower energy cost is a factor, so is reliability. To the extent that these companies wish to continue to operate in their home countries, but with better economics, the lower-cost natural gas product has led to the construction and development of export terminals on the U.S. coasts, feeding import terminals abroad with liquefied natural gas (LNG). Even with the liquification and transport costs, the economics in the current market are attractive, not to mention the carbon emission benefits.

For real asset investors, these infrastructure advancements highlight the continuum of global capital investment, something that developing and developed nations encourage. In fact, we see global competition in the demand for companies and management teams that can bring the above type of intellectual capital to the table that can deliver complex solutions to vast infrastructure needs throughout the world.

Physical Infrastructure

Pre-COVID, commercial real estate was already incorporating major initiatives to become more “green,” as it had proven to be as economically prudent as it was environmentally responsible. Developers are providing the next generation of structures that not only incorporate the new wave of “smart” technology in everything from office towers to apartment buildings.

However, proliferation of data centers and wireless towers may have more impact. Despite seemingly occurring in the background, these developments serve as the nerve center of the data superhighway through the wireless spectrum and fiber networks. The proliferation of cyber currency miners has further fueled data center demand.

That phenomenon aside, the huge amount of computing power extending from the consumer to corporate enterprise network traffic will continue to push investment in this communications infrastructure, which will also pressure the very demand on the grid that was discussed above.

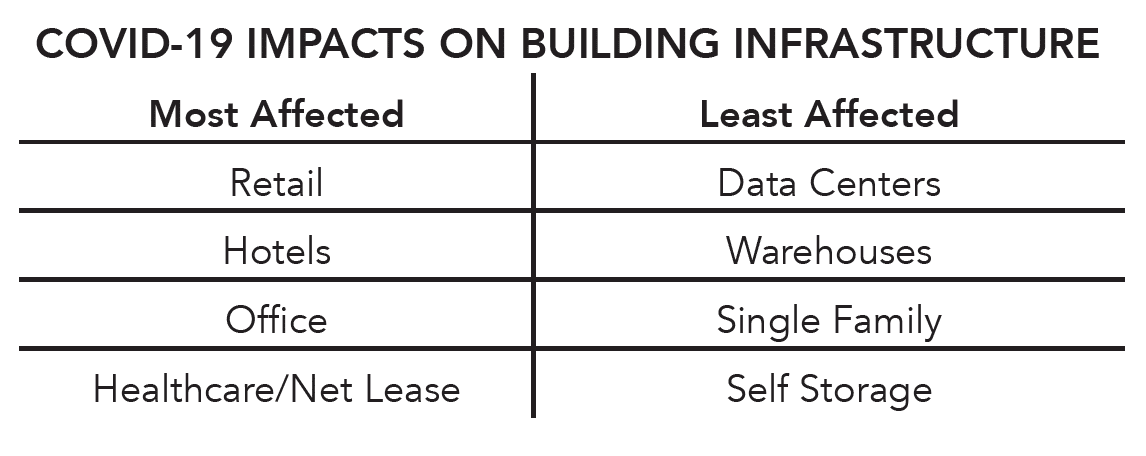

The epidemic-driven lockdowns fueled a massive work-from-home transition, accelerating home shopping (and banking, meal delivery, etc.) transactions. This effectively replaced in-person activity from bricks and mortar retail to the Internet, and the major logistics warehouse networks responded to provide the now ubiquitous overnight retail delivery demand. An entire new generation of distribution facilities (some complete with robotics) are the effective bricks and mortar replacement for retail and are being developed nationwide.

CHART 3:

Structural innovation incorporating multiple advancements has filtered into residential real estate with smart home devices (live), shared working environment-designed office layouts (work), and countless gaming and social networks (play). This live, work and play construct has prompted many new apartment and housing associations to incorporate these networks within the complex infrastructure not only to improve productivity but also to enhance the overall resident experience.

On a practical basis, this “Internet of Things,” such as lighting systems and thermostats, also deliver energy savings. Developers and operators have found that from the Millennial demographic on down, these types of experiences are expected. Office (co-working spaces), industrial, data center, and wireless towers, to name a few, also are rapidly incorporating the latest smart devices.

Further along, charging platform installations for the expected growth in EVs are already underway in both commercial and residential settings. For infrastructure investors, we believe that the fiber/wireless access and reliable green/renewable power installation that will provide the platform for these forward-looking, environmentally efficient technologies are not an option, but a requirement in the future for a long-lived asset.

Inflation

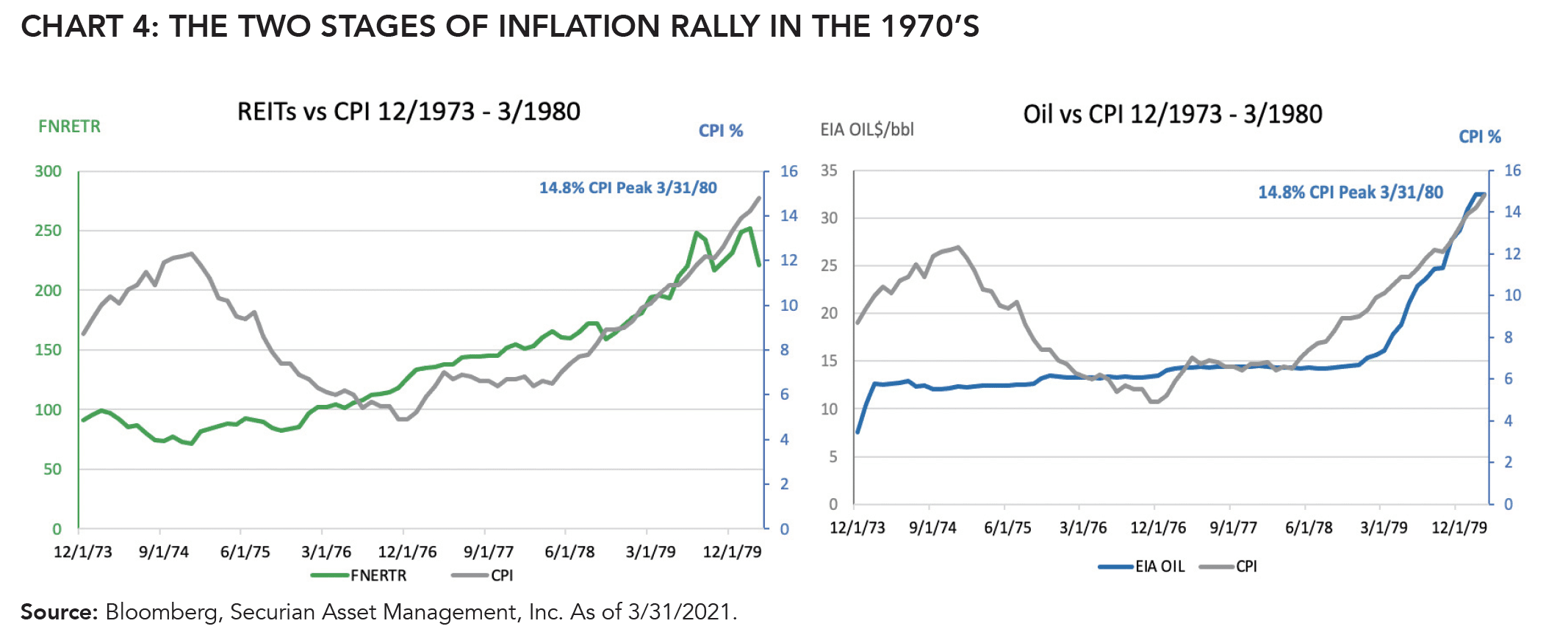

Many analysts have plotted investment performance vs. inflation, but the U.S. economy has not experienced sustained elevated inflation since the 1970’s and early 1980’s. From a true comparison perspective, we have taken a slice of the period that encompasses the two stages of Consumer Price Index (CPI) growth in the seventies, spanning the approximate mid-stage of the first climb through the peak at yearend 1974, followed by a trough in 1977 with a higher peak in the first quarter of 1980.

In our view, granular data for the period for these asset types is spotty. To demonstrate how Commercial Real Estate and Energy tracked this period, we selected what we believe are the two most appropriate proxies with data series that span that period: the price movement of the FTSE NAREIT Equity REITs Index (FNRE), an index of publicly traded Real Estate Investment Trusts, or REITs, and the price of oil (EIA OIL), as a proxy for energy costs, as published by The U.S. Energy Information Administration. Both deliver data tracking back to 1972. Granted, this is a high-level analysis, yet from an optical standpoint you can see in Chart 4 that on a nominal basis, they track well.

Summary: The Future Wave of Active Investing in Real Assets

In summary, current income streams generated by real assets, the potential for growth of those income streams, and the liquid nature of the publicly traded investments relative to other hard asset (i.e., commodity or private equity) investments are all desirable attributes to this investment approach. During certain periods, energy and physical infrastructure assets may have a low correlation in performance against one another, which mathematically helps reduce overall portfolio volatility.

Also, an aspect of the investing future that may be overlooked as we scan the potential inflationary asset horizon is the financial leverage that many infrastructure companies and REITs enjoy. They are typically long-term assets with contractual income (rents/fees) that are financed longer term with low-cost debt, which may allow for tremendous upside if these companies capture inflationary increases in income. We believe that strong balance sheet analysis is integral to active investing in the real asset environment for this reason.

Finally, an asset portfolio structured with infrastructure companies that provides the base for contracted revenue must continually evolve with the technological advancements, highlighting the importance of active management as this infrastructure wave drives investment.

Real asset classes are becoming more intertwined and reliant upon one another, and we believe that understanding how this drives demand and future investment requires broad knowledge across the spectrum.

Recognition that all industries are essentially now tech industries more so than in the past, requires constant research and surveillance for successful real asset investment.

About Lowell Bolkin

As Vice President and Portfolio Manager, Lowell Bolkin is involved in the management of the Real Estate Securities and Real Asset Income portfolios. Active in the investment industry since 1989, Lowell’s hands-on experience in the real estate market includes property management, leasing, negotiating sales and placement of financed debt. Prior to joining the firm, Lowell was the head of Corporate Bond Research at RBC Dain Rauscher, focusing on utilities and other higher yielding sector investments. Lowell is a CFA Charterholder, and a member of the CFA Institute and CFA Society of Minnesota. Lowell has a Master of Business Administration in Real Estate and Financial Markets from Columbia Business School at Columbia University and a Bachelor of Arts in Computer Science from the University of North Dakota.

About Securian Asset Management, Inc.

As a financially stable non-public company, Securian Asset Management focuses on the long-term and execute consistently for our clients. Our asset management business has been built with a risk and liability management focus, coming from our long, successful history investing for our parent company’s general account. We stay true to our purpose, our values and our St. Paul, MN roots, while being innovative and nimble to help prepare our clients to meet their investment objectives from a position of strength.

About Liberty Street

The Liberty Street Funds offer investors and financial advisors mutual funds sub-advised by independent boutique managers who possess expertise in their asset class. Because Liberty Street focuses on boutique managers, financial advisors can provide value-added strategies in actively managed and less-correlated portfolios to their clients. Through its selective multi-manager family of funds, Liberty Street provides access to timely investment strategies. The Liberty Street Funds are based in New York City, NY and advised by Liberty Street Advisors, Inc. HRC Fund Associates, LLC, Member FINRA/SIPC, is an affiliate of Liberty Street.

For more information, financial professionals should contact their wholesaler by calling HRC Fund Associates, LLC. Advisors, Inc. at libertystreet@hrcfinancialgroup.com or 212-240-9726. Individual investors and shareholders should contact their financial advisor, or the Fund at 800-207-7108.

Risks and Other Disclosures

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about the Securian AM Real Asset Income Fund (the “Fund”), please visit the Fund’s website at LibertyStreetFunds.com or call 1-800-207-7108. Read the prospectus carefully before investing.

An investment in the Fund is subject to risk, including the possible loss of principal amount invested and including, but not limited to, the following risks: Market Turbulence Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund. Real Estate Securities Risk: These include risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Small-Cap and Mid-Cap Companies Risk: Investing in small and medium-sized companies involves greater risks than those associated with investing in large company stocks, such as business risk, significant stock price fluctuations and illiquidity. The Fund may invest in smaller or medium-sized companies, which involve additional risks such as limited liquidity and greater volatility than large companies. The Fund may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. ETF/ETN Risk: The Fund may invest in ETFs and ETNs, which are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. MLP Tax Risk: MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. Options/Futures Contracts Risk: The Fund may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. Leverage Risk: Covered calls may limit the upside potential of the underlying security. TIPS Risk: Interest payments on TIPS are unpredictable and will fluctuate as the principal and corresponding interest payments are adjusted for inflation. There can be no assurance that the CPI will accurately measure the real rate of inflation in the prices of goods and services. Diversification does not assure a profit or protect against loss in a declining market.

The Fund may not be suitable for all investors. We encourage you to consult with appropriate financial professionals before considering an investment in the Fund.

The FTSE Nareit Equity REITs Index contains all Equity REITs not designated as Timber REITs or Infrastructure REITs and is free-float weighted. S&P 500 Utilities Index is an index of those companies included in the S&P 500 that are classified as members of the GICS® utilities sector. One cannot invest directly in an index.

Consumer Price Index (CPI) – measures the average change in prices over time that consumers pay for a basket of goods and services.

The views in this material were those of the Fund’s Sub-advisor as of the date written and may not reflect its views on the date this material is first disseminated or any time thereafter. These views are intended to assist shareholders in understanding the Fund’s investment methodology and do not constitute investment advice.

The Fund is distributed by Foreside Fund Services, LLC.

Liberty Street Advisors, Inc. is the advisor to the Fund. The Fund is part of the Liberty Street Family of funds within the Investment Managers Series Trust.