Featuring Jonathan Browne

Portfolio Manager and Director of Research

Robinson Capital Management

Many investors have heard about SPACs over the past year; however, most still do not understand that they present one of the most asymmetric risk versus return opportunities available today. SPACs, or Special Purpose Acquisition Companies, are potentially compelling investments for investors looking for almost zero correlation with traditional fixed income markets, potential downside mitigation, and capital appreciation opportunities when a merger is announced.

Portfolio Manager Jonathan Browne of Robinson Capital Management answered questions about why Robinson Capital finds SPACs to be an intriguing investment opportunity, given their potentially attractive risk versus return profile.

Q: Jonathan, can you please outline for us what SPACs are?

A: Special Purpose Acquisition Companies (or blank check companies) are companies formed to raise capital in an initial public offering (“IPO”) with the purpose of using the proceeds to acquire one or more unspecified private businesses.

According to the Harvard Business Review, SPACs have revolutionized the private and public capital markets by providing many companies the ability to raise more funds than alternative options, and propelling innovation in a broad range of industries.

Q: What is the history of the SPAC market and how have they grown so much in the last several years?

A: SPACs have been around for over 30 years. They were initially a means for a company to access the public markets when the traditional IPO route may not have been available or difficult to enter. A new shareholder-friendly environment has created an attractive option to access the public market other than the traditional IPO route. Currently there are almost 550 SPACs all searching for merger targets with over $150 billion in proceeds.

SPACs have grown rapidly during the past two years, according to research by Wells Fargo. In 2019, fifty-nine were created, with $13 billion invested; in 2020, 247 were created, with $80 billion invested; and in the first quarter alone of 2021, 295 were created, with $96 billion invested. In 2020, SPACs accounted for more than 50% of new publicly listed U.S. companies.

Q: How exactly do SPACs work—can you walk us through the various stages of a SPAC’s life cycle?

A: SPACs raise capital to make an acquisition through an initial public offering (IPO). A typical SPAC IPO includes common stock and a fraction of a warrant. A warrant gives the holder the right to buy more stock at a fixed price at a later date. The typical IPO price for a SPAC is $10. The exercise price but not an obligation for the warrants is typically set about 15% above the IPO price or $11.50.

After the IPO, the SPAC’s management team searches for a potential acquisition target. SPACs generally have a 18-24 month life cycle to complete a business combination. During this period, the SPAC stock typically trades near its IPO price since the proceeds are held in short-dated treasury bills—although SPACs can fall below the IPO price. SPACs can also trade at a premium to the IPO price if shareholders believe management will identify a compelling acquisition target. During the time it takes to find a target, a SPAC will usually trade near its cash value, which is typically $10. After announcing a merger target, however, investors will evaluate the deal and usually bid the SPAC up.

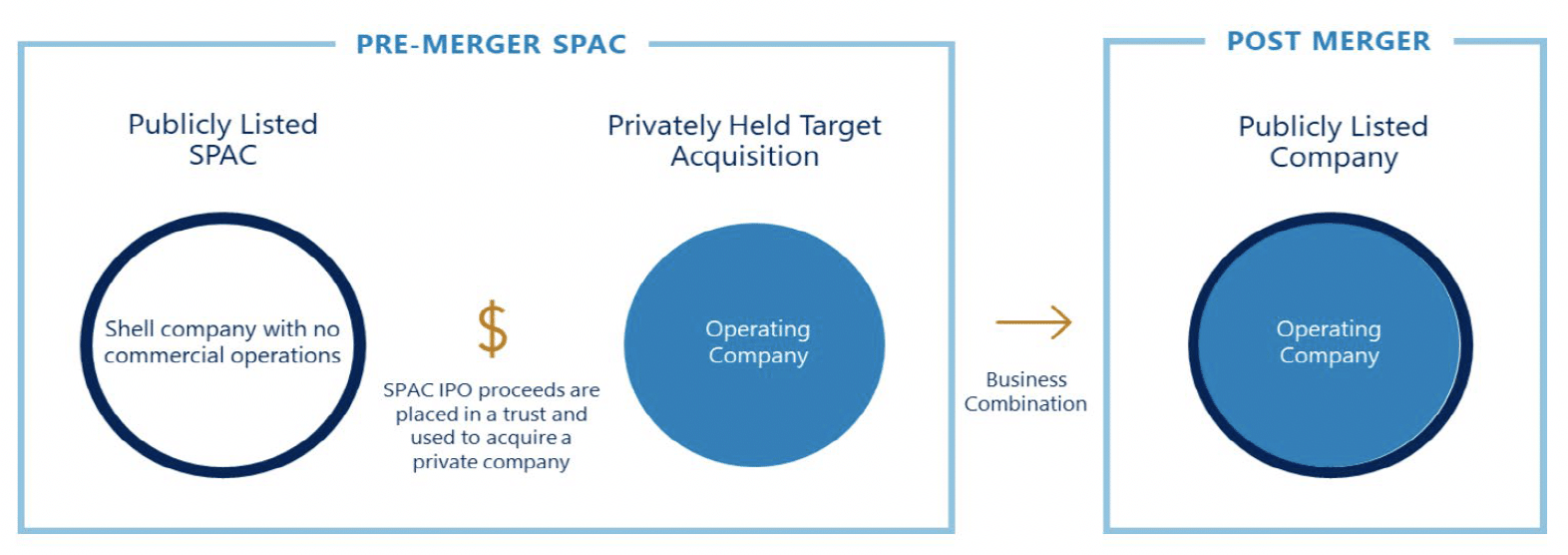

Q: Can you draw a picture for us of what a pre- and post-merger SPAC looks like?

A: As the chart below illustrates, a pre-merger SPAC is a shell company with no business operations. SPAC investors look for a privately held acquisition target. A post-merger SPAC is a publicly listed company with full commercial operations.

Q: SPACS have been in the news of late. Why are some SPACs controversial?

A: The last phase, the post-merger phase, is the most controversial phase of a SPAC’s lifecycle. This only occurs after the SPAC closes the deal and its ticker changes. After the ticker changes, investors can no longer redeem their shares for a pro rata portion of the trust and the merger closes. In recent months the financial media has focused on the poor performance of post-merger SPACs, as though they were exclusively a SPAC-specific issue, and it is why some investors are wary of SPACs.

Q: When you look at SPACs in which to invest, how do you know a good, non-controversial SPAC from a bad, potentially troublesome one?

A: Institutional-quality research is needed to assess the large and growing SPAC universe. We rank the attractiveness of the SPAC universe based on the likelihood of identifying a deal, the price of the SPAC relative to the trust account value, and the value of the SPACs attached warrants. We also research the SPAC management team pedigree and experience, and

evaluate the relative attractiveness of targeted industries and/or regions. We then value the SPACs based on their targeted industry, remaining time, and probability of a business combination.

Q: So much for the potential bad news. What are the potential benefits of investing in SPACs?

A: Many SPACs currently provide a built-in return of two percent or more for investors, which in today’s low-rate environment can be extremely attractive. This advantage, coupled with capital appreciation opportunity, presents investors with a particularly attractive alternative to traditional fixed income strategies. SPACs require their proceeds to be placed in a trust account that by prospectus must be invested in Treasury bills of 6 months or shorter. In effect, a SPAC has the credit and interest rate risk of a relatively safe T-Bill portfolio. For example, if the trust value is $10 per share—and if management purchased the SPAC for $9.80 and can redeem upon liquidation or deal completion—then effectively we have locked in a worst-case scenario of a 2.00% return.*

Q: Why do you and your investment team only focus on the pre-merger SPAC universe?

A: We exclusively focus on pre-merger SPACs given their bond-like characteristics, potential downside protection and equity-like growth potential. We will exit a position prior to a merger being completed to mitigate against the market risk that the SPAC may experience after announcement of the merger.

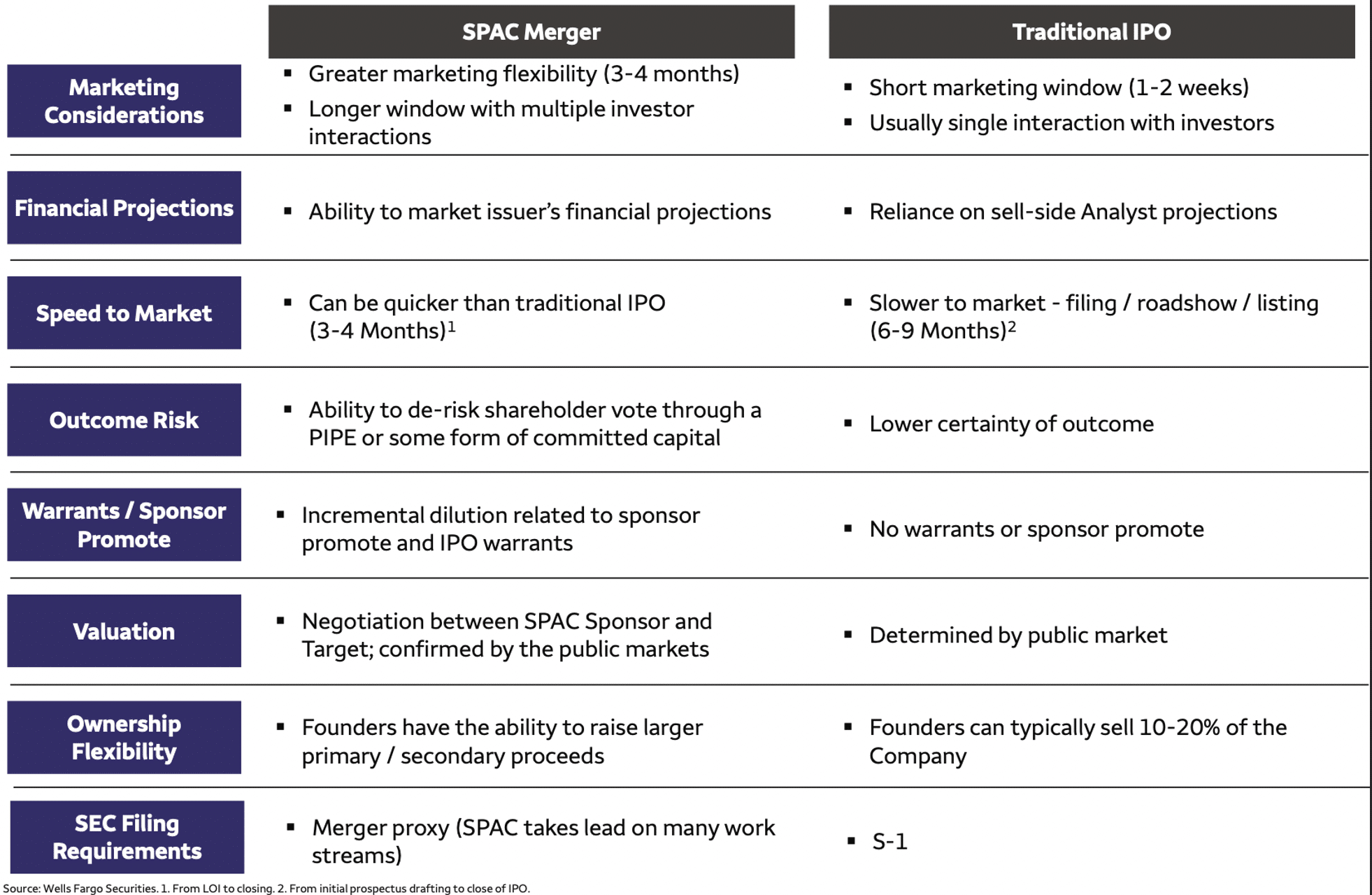

Q: How are SPACs different from IPOs?

SPACS and IPOs have significant differences in financial projections, speed to market, risk profile, valuation, ownership, and SEC filing requirements, among others. One example is how quickly a sponsor can bring a SPAC to market. A traditional IPO may take 6-9 months; a SPAC, by contrast, may only take 3-4 months.

*Investing involves risks; principal loss is possible. The proceeds of a SPAC that are placed in trust are subject to risks, including the risk of insolvency of the custodian of the funds, fraud by the trustee, interest rate risk and credit and liquidity risk relating to the securities in which the proceeds are invested. SPACs invest their trust assets in U.S. Treasuries or money market funds, which may also be at risk for loss at various times. For Illustrative Purposes Only, not representative of a specific investment.

In Summary

In summary, Robinson Capital finds SPACs to be an attractive investment opportunity to complement a traditional fixed income portfolio with potential for capital appreciation.

For More Information

For more information on the Robinson Opportunistic Income Fund, financial professionals should contact their wholesaler by calling HRC Fund Associates, LLC at libertystreet@hrcfinancialgroup.com or 212-240-9726. Individual investors and shareholders should contact their financial advisor, or the Fund at 800-207-7108

About Risks of Investing in SPACs

Unless and until an acquisition is completed, a SPAC generally invests its assets (less a portion retained to cover expenses) in U.S. government securities, money market fund securities and cash. If an acquisition that meets the requirements for the SPAC is not completed within a pre-established period of time, the invested funds are returned to the entity’s shareholders, less certain permitted expenses, and any warrants issued by the SPAC will expire worthless. Therefore, an investor may suffer a complete loss of its investment in a SPAC’s warrants. As SPACs and similar entities generally have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. Certain SPACs may pursue acquisitions only within certain industries or regions, which may increase the volatility of their prices. In addition, certain of these securities, which are typically traded in the over-the-counter market, may be considered illiquid and/or be subject to restrictions on resale. An investment in a SPAC is subject to a variety of additional risks, including that (i) any proposed merger or acquisition may be unable to obtain the requisite approval, if any, of SPAC shareholders; (ii) an acquisition or merger, once effected, may prove unsuccessful and an investment in the SPAC may lose value; (iii) the investor may be delayed in receiving any redemption or liquidation proceeds from a SPAC to which it is entitled; (iv) an investment in a SPAC may be diluted by additional later offerings of interests in the SPAC or by other investors exercising existing rights to purchase shares of the SPAC; (v) only a thinly traded market for shares of or interests in a SPAC may develop, or there may be no market at all, leaving the investor unable to sell its interest in a SPAC or to sell its interest only at a price below what the investor believes is the SPAC interest’s intrinsic value; and (vi) the values of investments in SPACs may be highly volatile and may depreciate significantly over time.

About Jonathan P. Browne

Jonathan Browne serves as a Portfolio Manager and member of the investment management team at Robinson Capital. He jointly oversees the day-to-day management of the Robinson Funds, including its investment strategies and processes, risk management, regulatory compliance, asset allocation modeling, external manager due diligence and selection, and trading. He is also responsible for overseeing the continued growth and advancement of the firm’s closed-end fund research and trading efforts, which includes managing Robinson Capital’s proprietary closed-end fund valuation systems.

Prior to joining Robinson Capital Management, Jon worked as an Associate Portfolio Manager for Federated Investors, Inc. In that role, he helped manage several income focused, multi-asset class portfolios and SMA portfolios. In addition to his portfolio management responsibilities, Jon also served as a Research Analyst, providing fundamental equity research across various industries.

Previously, Jon worked for three years as a Senior Consultant at FactSet Research Systems Inc., where he developed proprietary models and streamlined investment processes for institutional investors, such as hedge fund managers, plan sponsors, and private wealth advisors. Jon holds both a B.S. and MBA in Finance and Economics from Carnegie Mellon University.

About Robinson Capital

Founded in 2012, Robinson Capital Management employs both fundamental and tactical techniques to select and manage the two funds they sub-advise. The company specializes in traditional and alternative fixed income investing strategies. These approaches often employ closed-end mutual funds that offer the potential to generate higher cash flow yields while providing low correlations with stock and bond markets.

About Liberty Street

The Liberty Street Funds offer investors and financial advisors mutual funds sub-advised by independent boutique managers who possess expertise in their asset class. Because Liberty Street focuses on boutique managers, financial advisors can provide value-added strategies in actively managed and less-correlated portfolios to their clients. Through its selective multi-manager family of funds, Liberty Street provides access to timely investment strategies. The Liberty Street Funds are advised by Liberty Street Advisors, Inc. HRC Fund Associates, LLC, Member FINRA/SIPC, is an affiliate of Liberty Street.

Risks and Other Disclosures for the Robinson Opportunistic Income Fund (the “Fund”)

Effective June 28, 2021, changes were made to the Robinson Opportunistic Income Fund’s principal investment strategy. The Fund may invest in special purpose acquisition companies (“SPACs”) as part of the principal investment strategy.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information are in the prospectus and summary prospectus, a copy of which may be obtained on this website or by calling (800) 207-7108. Please read the prospectus or summary prospectus carefully before you invest.

An investment in the Fund is subject to risk, including the possible loss of principal amount invested and including, but not limited to, the following risks, which are more fully described in the prospectus.

Market Risk: The market price for a security may decline, sometimes rapidly or unpredictably, due to general market conditions that ae not specifically related to a particular issuer, company, or asset class. Local, regional or global events such as the spread of infectious illness or other events could have a significant impact on a security or instrument.

Fixed income/interest rate risk: A rise in interest rates could negatively impact the value of the Fund’s shares. Generally, fixed income securities decrease in value if interest rates rise, and increase in value if interest rates fall, with longer-term securities being more sensitive than shorter-term securities.

High yield (“junk bond”) risk: High yield (“junk”) bonds are speculative, involve greater risks of default, downgrade, or price declines and are more volatile and tend to be less liquid than investment-grade securities.

Closed-end fund (CEF), exchange-traded fund (ETF) and open-end fund (Mutual Fund) risk: The Fund’s investments in CEFs, ETFs and Mutual Funds (“underlying funds”) are subject to various risks, including management’s ability to manage the underlying fund’s portfolio, risks associated with the underlying securities, fluctuation in the market value of the underlying fund’s shares, and the Fund bearing a pro rata share of the fees and expenses of each underlying fund in which the Fund invests.

COVID-19 Related Market Events: the outbreak of COVID-19 has negatively affected the U.S. and worldwide economy. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund. Management Risk: selection of Fund investments is dependent on views of the Sub-advisor.

Derivatives risk: The Fund and the underlying funds may use futures contracts, options, swap agreements, and/or sell securities short. Futures contracts may cause the value of the Fund’s shares to be more volatile and expose the Fund to leverage and tracking risks; the Fund may not fully benefit from or may lose money on option or shorting strategies; swaps may be leveraged, are subject to counterparty risk and may be difficult to value or liquidate.

Leveraging risk: The underlying Funds in which the Fund invests may be leveraged as a result of borrowing or other investment techniques. As a result, the Fund will be exposed indirectly to leverage through its investment in an underlying fund that utilizes leverage. The use of leverage may magnify the Fund’s gains or losses and make the Fund more volatile.

SPACs Risk: Unless and until an acquisition is completed, a SPAC generally invests its assets (less a portion retained to cover expenses) in U.S. government securities, money market fund securities and cash. To the extent the SPAC is invested in cash or similar securities, this may impact the Fund’s ability to meet its investment objective. If an acquisition that meets the requirements for the SPAC is not completed within a pre-established period of time, the invested funds are returned to the entity’s shareholders, less certain permitted expenses, and any warrants issued by the SPAC will expire worthless. Therefore, the Fund may suffer a complete loss of its investment in a SPAC’s warrants. As SPACs and similar entities generally have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. Certain SPACs may pursue acquisitions only within certain industries or regions, which may increase the volatility of their prices. In addition, certain of these securities, which are typically traded in the over-the-counter market, may be considered illiquid and/or be subject to restrictions on resale. An investment in a SPAC is subject to a variety of additional risks, including that (i) any proposed merger or acquisition may be unable to obtain the requisite approval, if any, of SPAC shareholders; (ii) an acquisition or merger, once effected, may prove unsuccessful and an investment in the SPAC may lose value; (iii) the Fund may be delayed in receiving any redemption or liquidation proceeds from a SPAC to which it is entitled; (iv) an investment in a SPAC may be diluted by additional later offerings of interests in the SPAC or by other investors exercising existing rights to purchase shares of the SPAC; (v) only a thinly traded market for shares of or interests in a SPAC may develop, or there may be no market at all, leaving the Fund unable to sell its interest in a SPAC or to sell its interest only at a price below what the Fund believes is the SPAC interest’s intrinsic value; and (vi) the values of investments in SPACs may be highly volatile and may depreciate significantly over time.

ETN risk: Investing in ETNs exposes the Fund to the credit risks of the issuer.

Tax risk: There is no guarantee that the Fund’s distributions will be characterized as income for U.S. federal income tax purposes.

Liquidity Risk: There can be no guarantee that an active market in shares of CEFs and ETFs held by the Fund will exist. The Fund may not be able to sell some or all of the investments it holds due to a lack of demand in the marketplace or other factors such as market turmoil, or if the Fund is forced to sell an asset to meet redemption requests, it may only be able to sell those investments at a loss

Portfolio Turnover Risk: The Fund’s turnover rate may be high. A high turnover rate may lead to higher transaction costs, a greater number of taxable transactions, and negatively affect the Fund’s performance.

Bank loan risk: The underlying funds may invest in loan participations of any quality, including “distressed” companies with respect to which there is a substantial risk of losing the entire amount invested.

LIBOR risk: Many financial instruments use a floating rate based on the London Interbank Offered Rate (“LIBOR”), which is expected to expire by the end of 2021. Any effects of the transition away from LIBOR could result in losses.

Convertible securities risk: The underlying funds may invest in convertible securities, which are subject to market risk, interest rate risk, and credit risk.

Preferred stock risk: The underlying funds may invest in preferred stock, which is subject to company-specific and market risks applicable to equity securities, and is also sensitive to changes in the company’s creditworthiness and changes in interest rates.

Definitions:

Initial Public Offering (IPO): is a public offering in which shares of a company are sold to institutional investors and usually also retail investors. Merger Targets: refers to a company chosen as an attractive merger or acquisition option by a potential acquirer. Short Dated Treasury Bills: are short-term government securities with maturities ranging from a few days to 52 weeks. Trading at a Premium: is a strategy that involves tactically pricing your company’s product higher than your immediate competition. Acquisition Target: refers to a company chosen as an attractive merger or acquisition option by a potential acquirer. Actual Cash Value: is the amount equal to the replacement cost minus depreciation of a damaged or stolen property at the time of the loss. Bid: refers to the highest price a buyer will pay to buy a specified number of shares of a stock at any given time. Pro Rata Portion: that is used to assign or allocate value in proportion to something that can accurately and definitively be measured or calculated. PIPE (Private Investment in Public equity): refers to any private placement of securities of an already- public company that is made to selected accredited investors (usually to selected institutional accredited investors).

The Fund may not be suitable for all investors. We encourage you to consult with appropriate financial professionals before considering an investment in the Fund

The Funds advised by Liberty Street Advisors are distributed by Foreside Fund Services, LLC.